Introduction

Many small businesses struggle to control spending and manage expenses. Soldo: Financial Services Ltd (United Kingdom) offers a digital wallet and corporate cards for better expense management.

This blog explains how Soldo helps with spend management, payment automation, and business agility. Read on to see how your company can benefit from these financial services.

1.How Soldo Helps Businesses Manage Their Finances

Soldo provides businesses with a customizable solution for managing decentralized spending. It establishes strong financial controls and streamlines everyday administrative tasks, making finance management simpler and more efficient.

1.1) Customizable solution for decentralized spending

Soldo offers a customizable solution for decentralized spending. This approach gives small and medium-sized businesses (SMBs) the flexibility they need. With Soldo, companies can set limits and controls on employee spending.

Each team member gets access to multiuser accounts tailored to their needs.

This system simplifies expense management by allowing employees to use corporate cards while staying within budget. Real-time insights into spending help businesses monitor expenses closely.

Payment automation further streamlines processes, reducing administrative burdens and enhancing overall financial control.

1.2) Establishing financial controls

After discussing a customizable solution for decentralized spending, establishing financial controls plays a crucial role in managing business finances effectively. Financial controls help businesses monitor expenses closely.

They enable companies to set limits on spending and track every transaction. This ensures that employees can spend responsibly while staying within budget.

Setting up corporate cards with predefined limits reinforces these controls. Multiuser accounts allow managers to oversee multiple team members’ transactions easily. Real-time insights into spending empower decision-makers to act quickly when issues arise.

Using an expense management platform simplifies tracking and provides clear visibility of business expenses, making it easier to adhere to financial regulations in the UK.

For subscription

1.3) Streamlining administrative tasks

Soldo simplifies administrative tasks for small and medium-sized businesses. The platform automates expense management, which saves time and reduces errors. With Soldo’s digital wallet, companies can manage spending through corporate cards linked to multiuser accounts.

Employees quickly access funds while adhering to financial controls set by management.

This system helps organizations track business spending in real-time. It eliminates the need for manual expense reports, making accounting easier. Payment automation streamlines processes and improves overall efficiency.

By focusing on automatic solutions, SMBs can concentrate on growing their business instead of worrying about finances.

2.The Benefits of Using Soldo

Soldo boosts business agility by simplifying spending processes. It empowers employees to manage expenses wisely while providing real-time insights into company finances.

2.1) Boosting business agility

Soldo boosts business agility by offering a flexible spend management solution. Companies can customize it to fit their specific needs, allowing for decentralized spending across teams.

Financial controls help ensure that employees make responsible decisions when using corporate cards and multiuser accounts.

Real-time insights on spending provide quick access to critical financial data. This level of transparency enhances accountability and streamlines administrative tasks. Businesses save time and resources, which enables them to focus on growth while managing expenses effectively with Soldo’s digital wallet features.

2.2 ) Empowering employees to spend responsibly

Soldo empowers employees to spend responsibly by giving them smart tools for managing company funds. With Soldo’s corporate cards, workers can make purchases within predefined limits.

This approach fosters trust and accountability among team members. Employees gain flexibility while sticking to budget guidelines.

Real-time insights on spending help businesses monitor transactions closely. Companies can set financial controls that align with their goals. This boosts business spending efficiency and minimizes errors in expense management.

Creating a culture of responsible spending benefits both employees and the organization as a whole. Businesses simplify payment automation, paving the way for smoother operations ahead.

2.3) Real-time insights on spending

Soldo provides real-time insights on spending for small and medium-sized businesses. With this feature, companies can monitor expenses instantly. Users access clear data on who spends what and where money goes.

This information helps identify trends and control budgets more effectively.

Financial services like Soldo’s expense management platform empower teams to make informed decisions quickly. Businesses avoid overspending by setting limits and tracking transactions in real time.

Using multiuser accounts simplifies managing corporate cards across different departments. This level of visibility enhances financial controls while allowing employees to spend responsibly, all within an easy-to-use digital wallet system.

Conclusion

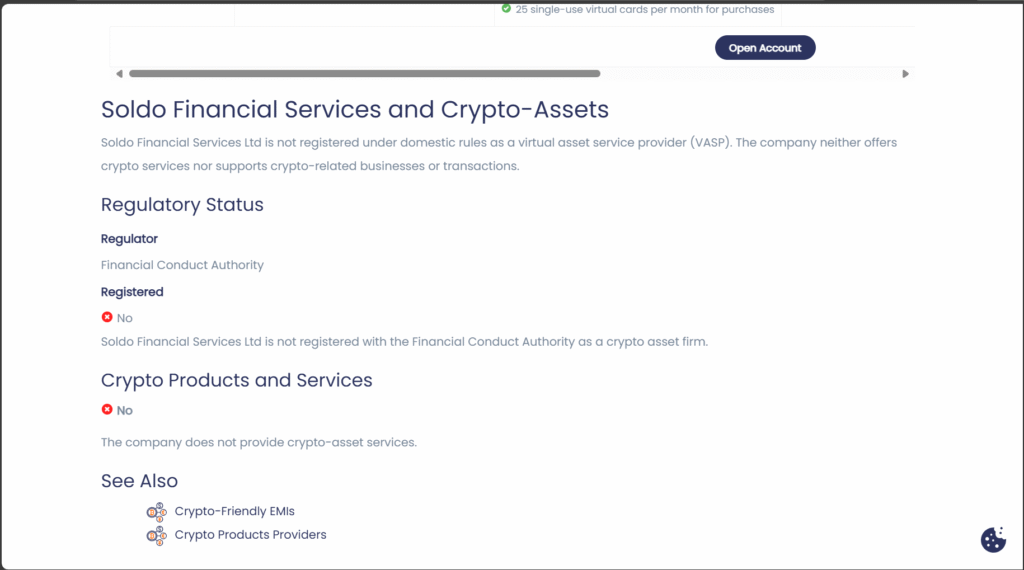

Soldo simplifies financial management for small and medium-sized businesses. Their platform offers easy expense control through customizable solutions. Users can access real-time insights on spending habits, allowing for smarter decisions.

With corporate cards and multiuser accounts, businesses streamline their operations effectively. Soldo empowers teams to manage finances while staying compliant with UK regulations.