Introduction

CreditVana has quickly become a popular name in the world of credit monitoring and financial wellness. Whether you’re trying to build better credit, track your score, or understand your overall financial health, CreditVana offers tools designed to make that easier. In this guide, we’ll take a closer look at what CreditVana is, how it works, and why so many people are turning to it in 2025 to take control of their credit journey.

1) Here’s What You Need to Know

CreditVana is an online platform that helps users understand, track, and improve their credit health. It offers access to your credit information in one convenient dashboard, giving you the insights you need to make smarter financial decisions.

1.1) What CreditVana Does?

CreditVana provides free credit score tracking, credit report analysis, and personalized tips to help users strengthen their financial standing. It pulls information from major credit bureaus and displays it in a user-friendly dashboard, allowing you to see exactly what’s helping or hurting your score.

1.2) Key Features and Tools

Here are some of the standout tools that make CreditVana useful for managing credit:

Credit Score Monitoring: Stay updated with real-time changes to your credit score.

Credit Report Breakdown: Understand every section of your credit report, including payment history and utilization ratio.

Personalized Insights: Get clear suggestions on how to raise your score, based on your unique credit profile.

Identity Protection: Some plans include alerts for suspicious activity or potential identity theft.

Financial Education Resources: Access articles and tips about loans, credit cards, and budgeting.

1.3) Why People Use CreditVana

Users choose CreditVana because it saves time and removes the confusion that often comes with understanding credit reports. Instead of checking multiple sites or waiting for mailed statements, everything is in one simple dashboard. The platform focuses on clarity, convenience, and accuracy — three things that are essential for effective credit management.

It’s especially helpful for:

People rebuilding their credit after debt or late payments

Young adults learning about credit for the first time

Anyone preparing to apply for a mortgage, loan, or new credit card

1.4) Is CreditVana Free?

One of the biggest questions users ask is whether CreditVana is free. The answer: yes, it offers a free version with essential features such as credit score checks and alerts. However, there may also be premium options with advanced analytics, fraud alerts, and detailed reports for users who want more control over their credit data.

2) How It Works and Why People Use It ?

Understanding how it works and why people use it can help you see the real value behind this tool. At its core, it’s designed to make tasks faster, simpler, and more efficient. The process usually starts when a user inputs information or performs an action — then the system processes that data in real time and produces accurate results. This seamless flow is what makes it easy to use, even for beginners.

The reason people use it varies, but most are drawn to its reliability, speed, and convenience. Whether it’s for work, learning, or personal use, this tool saves time and reduces effort. Many users also appreciate that it doesn’t require technical expertise — you can get started quickly and see results almost instantly.

The reason people use it varies, but most are drawn to its reliability, speed, and convenience. Whether it’s for work, learning, or personal use, this tool saves time and reduces effort. Many users also appreciate that it doesn’t require technical expertise — you can get started quickly and see results almost instantly.

3) How CreditVana Helps You Improve Your Credit Score Fas?

Improving your credit score doesn’t have to take months of guessing and frustration. CreditVana helps you improve your credit score fast by giving you clear insights, smart recommendations, and the right tools to take control of your financial future. Whether you’re building credit from scratch or trying to recover from past mistakes, CreditVana makes the process simple, personalized, and effective.

3.1) Real-Time Credit Monitoring

With CreditVana, you don’t have to wait for monthly updates. The platform provides real-time credit monitoring, alerting you instantly to any changes in your credit report—such as new accounts, inquiries, or score updates. This helps you stay informed and act quickly when something affects your score.

3.2) Personalized Action Plans

CreditVana doesn’t just tell you your credit score—it tells you what to do next. You’ll receive personalized action steps based on your unique credit profile. Whether it’s paying down certain balances, disputing errors, or optimizing your credit utilization, these actionable insights are designed to help you improve your credit score fast.

3.3) Credit Builder Tools

The platform also includes built-in credit builder tools that make it easier to establish a positive credit history. From secured card recommendations to low-interest credit-building loans, CreditVana gives you safe, guided options to boost your score effectively.

3.3) Error Dispute Assistance

Mistakes on credit reports are more common than most people think. CreditVana simplifies the dispute process by helping you identify potential errors and guiding you through fixing them step-by-step. Correcting these inaccuracies can often give your score a noticeable boost in a short time.

4) Real User Reviews You Should See

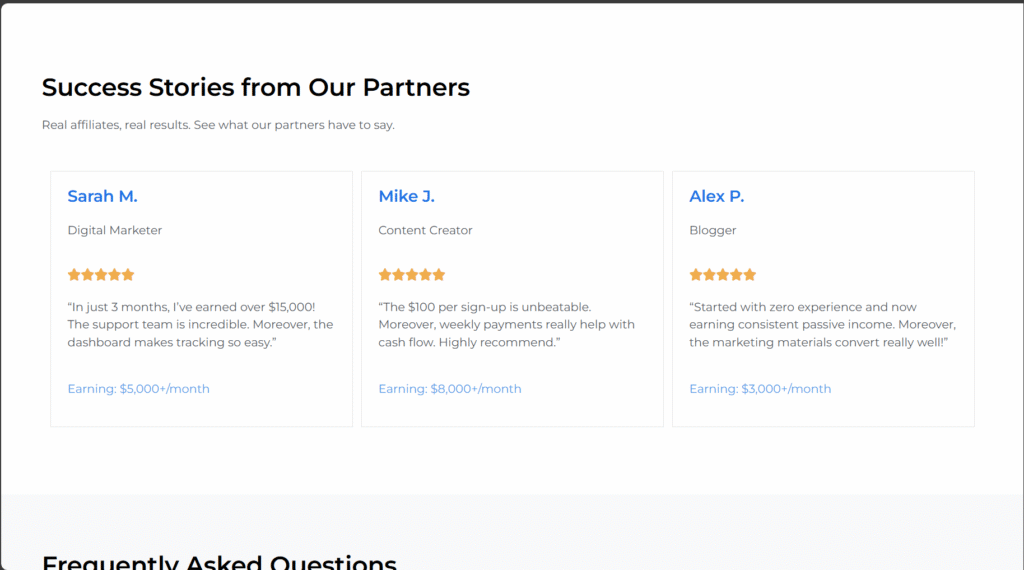

When choosing a product or service, real user reviews can make all the difference. They provide genuine insight from people who have already tried what you’re considering, helping you make smarter and more confident decisions. Instead of relying only on marketing claims, real user reviews reveal what works, what doesn’t, and what to expect before you buy.

These reviews often highlight important details—such as performance, reliability, and customer support—that you might not find in product descriptions. Reading real user reviews can also help you compare different options side by side, saving time and money in the long run.

Whether you’re shopping online, booking a service, or testing out a new app, pay attention to what real users are saying. Look for patterns in feedback: if several people mention the same pros or cons, that’s a strong indicator of the product’s true quality.

Most importantly, real user reviews build trust. They offer an honest look at real experiences, making it easier to decide if something truly meets your needs.

Conclusion

In today’s world, where choices are endless, real user reviews are one of the most reliable ways to make informed decisions. They give you an honest, first-hand look into real experiences—beyond polished marketing and sales promises. Whether you’re comparing products, exploring new services, or simply looking for quality and value, these reviews help you see what truly matters.

Take the time to read, compare, and learn from others’ experiences. The insights shared in real user reviews can save you from costly mistakes and guide you toward the best options available. Trust the voices of real users—they’re your best resource for smart, confident choices.